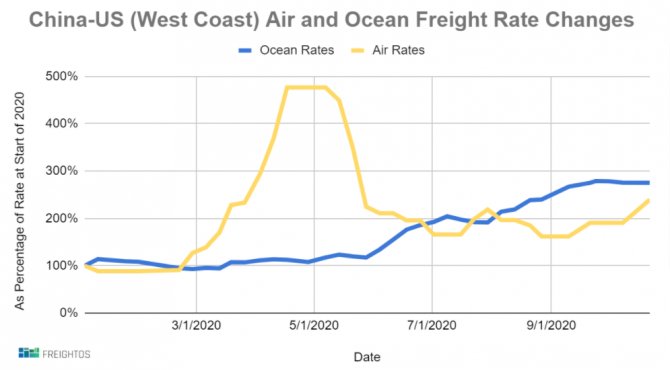

China-US ocean rates remain stable 'but extremely elevated'

Ocean rates from China to the US have now remained level “but extremely elevated” for five consecutive weeks, according to digital rates specialist Freightos.

Continued equipment shortages and unchanged prices, despite there being 20% more capacity available than last year, show that demand is still very strong. And while moves by regulators may have kept rate increases at bay since early September, anticipation is that prices will rise at some point in November,” noted chief marketing officer, Ethan Buchman.

According to the latest update of Freightos' Baltic Index, published on 28 October, China-US West Coast prices went unchanged at $3,844/FEU. This rate is 182% higher than the same time last year.

China-US East Coast prices were also stable at $4,664/FEU, and are 85% higher than rates for this week last year.

Buchman continued “All indications are that volumes will stay strong through November when peak season would normally fade. But after that, predictions are split: scheduled capacity, container leasing demand and production levels, and reports from forwarders point to a busy December and even early 2021.

“However, signs of a US recession, the pandemic’s growing second wave, and the lack of additional government stimulus are all potential indications that the current boom can’t be sustained for much longer.”

While ocean rates have stayed level even as capacity is increasing, air cargo rates out of China have started their peak season climb, as capacity remains 20% lower than last year.

Meanwhile, air cargo data from the Freightos.com marketplace show rates from China to the US and Europe have increased from 25% to as much as 45% in the last two weeks as consumer tech product launches, eCommerce and holiday season products have shippers competing for space, Buchman added.

LOJİPORT

Türkçe karakter kullanılmayan ve büyük harflerle yazılmış yorumlar onaylanmamaktadır.